|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

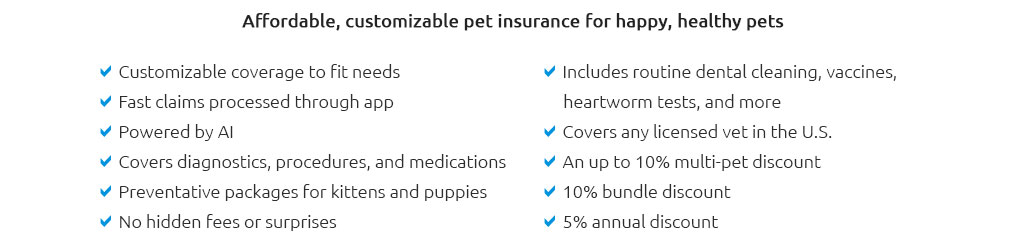

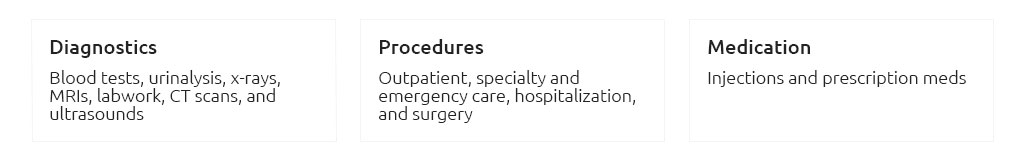

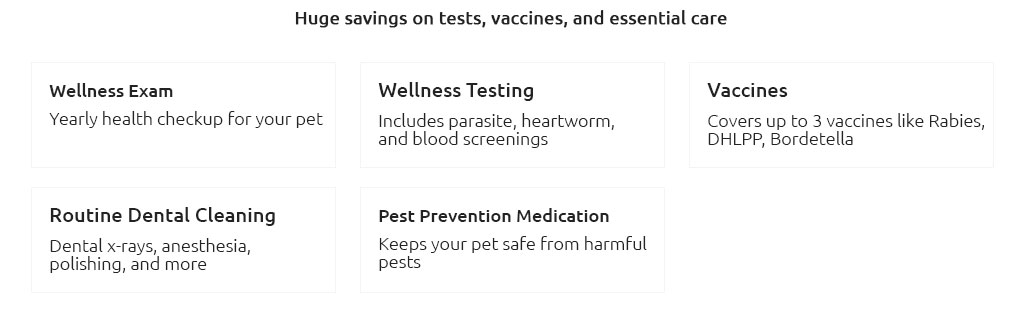

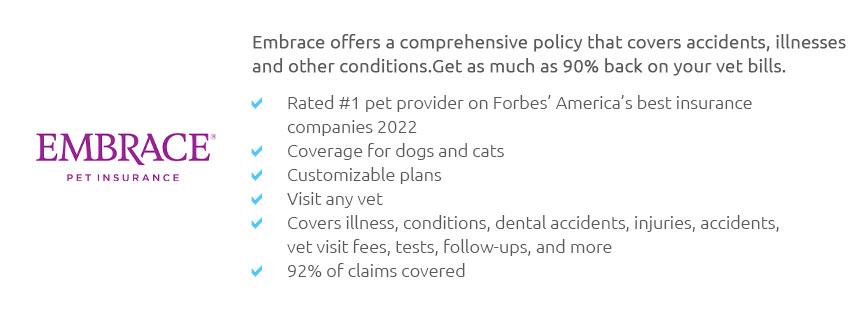

How Much for Dog Insurance: Navigating the Costs and BenefitsDog insurance, often regarded as a luxury by some, is increasingly becoming a necessity for responsible pet owners who wish to ensure their canine companions receive the best care possible. The question of 'how much for dog insurance' isn't merely about the financial outlay; it encompasses a broader discussion on value, peace of mind, and preparedness for life's unpredictable moments. Let's delve into the intricacies of dog insurance, examining costs, coverage, and considerations that every dog owner should weigh before making a decision. Firstly, understanding the cost factors of dog insurance is crucial. Premiums can vary widely based on several variables, including the breed, age, and health condition of your dog. For instance, insuring a young, mixed-breed dog typically costs less than covering a purebred or an older dog due to the varying likelihood of genetic conditions. On average, dog insurance can range from $30 to $50 per month. However, this is a broad estimate and actual costs can diverge significantly based on the coverage selected. Coverage options also play a pivotal role in determining the insurance cost. Basic plans usually cover accidents and illnesses, while more comprehensive policies might include wellness visits, vaccinations, and preventive care. Some plans even offer coverage for alternative therapies like acupuncture or hydrotherapy, reflecting the evolving landscape of veterinary care. It's essential to carefully review what each policy offers, considering both the short-term and long-term needs of your pet. Moreover, some insurance providers offer customizable plans that allow pet owners to adjust deductibles, reimbursement rates, and annual maximums. This flexibility can be beneficial, enabling you to tailor the insurance to fit your budget and your dog's specific needs. For instance, opting for a higher deductible may reduce monthly premiums, a strategy that might appeal to those who have a financial cushion to cover minor vet visits but want protection against major expenses. It's also worthwhile to look at real-world examples that illustrate the importance of dog insurance. Take the story of Max, a lively Golden Retriever whose owners opted for a comprehensive insurance plan. When Max was diagnosed with a hereditary condition that required surgery and ongoing treatment, the insurance covered a substantial portion of the costs, saving the family thousands of dollars. In contrast, Bella, a Beagle without insurance, faced an unexpected accident that led her owners to incur significant debt to cover her medical bills. These anecdotes highlight how dog insurance can be a financial lifesaver and a source of peace of mind. While the decision to invest in dog insurance ultimately rests with the owner, it's crucial to consider the potential costs of veterinary care without insurance. The American Pet Products Association reports that pet owners spend billions annually on veterinary care, with expenses often arising from unforeseen illnesses or accidents. Dog insurance can mitigate these costs, ensuring that financial constraints do not dictate the quality of care your dog receives. In conclusion, determining 'how much for dog insurance' involves more than just a monetary evaluation. It requires a thoughtful assessment of your dog's health needs, your financial situation, and your willingness to prepare for future uncertainties. With the right insurance plan, you can secure a healthier, happier life for your furry friend, allowing you to focus on what truly matters: the joy and companionship that only a beloved pet can provide. FAQ What factors influence the cost of dog insurance? The cost is influenced by factors such as the dog's breed, age, health condition, and the level of coverage selected. Generally, younger and mixed-breed dogs cost less to insure. Is it worth getting insurance for an older dog? While premiums may be higher, insurance can be beneficial for older dogs as they are more prone to health issues. It's important to assess the coverage options available for older pets. Does dog insurance cover preventive care? Some insurance plans offer coverage for preventive care, including vaccinations and wellness visits, but these are usually part of more comprehensive packages. Can I customize my dog insurance plan? Yes, many providers allow customization of plans, enabling you to adjust deductibles, reimbursement rates, and coverage limits to better suit your budget and needs. How do I choose the best dog insurance provider? Research multiple providers, compare coverage options and costs, read customer reviews, and consider recommendations from veterinarians to find the best fit for your dog. https://www.metlifepetinsurance.com/blog/pet-insurance/how-much-does-pet-insurance-cost/

Dog insurance typically costs more than cat insurance, and the national average in 2025 comes in at around $60 per month. Here's a look at some of the average ... https://www.bankrate.com/insurance/pet-insurance/how-much-does-pet-insurance-cost/

The cost of pet insurance typically falls between $17 and $101 per month for dogs and $10 to $32 for cats. - Several factors influence monthly ... https://www.cbsnews.com/news/how-much-pet-insurance-do-i-need/

Pet insurance is an inexpensive but valuable form of protection. On average, it costs $30 to $70 per month for a dog and $15 to $40 per month for a cat.

|